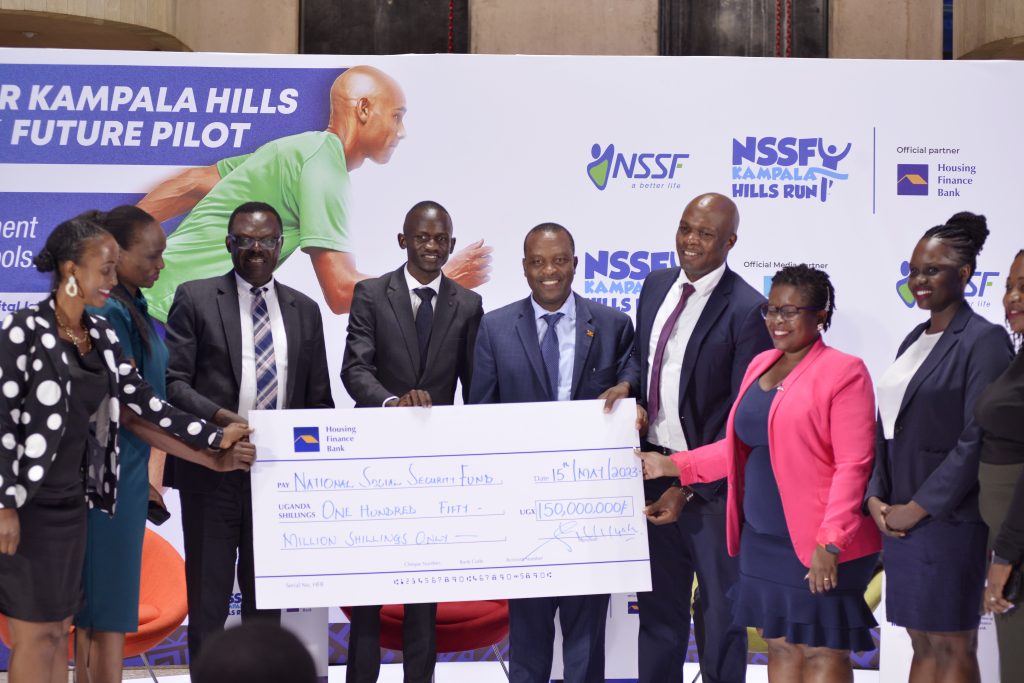

We are excited to announce yet another significant step in our Sustainability journey. On Tuesday 28, March 2023, the Housing Finance Bank Executive team led by Mr. Michael K. Mugabi…

![]()

© 2022 Housing Finance Bank. Investment House, 4 Wampewo Avenue, Kololo. Housing Finance Bank is regulated by Bank of Uganda. Customer deposits are protected by the Deposit Protection Fund of Uganda up to UGX 10 million. Terms and Conditions apply.