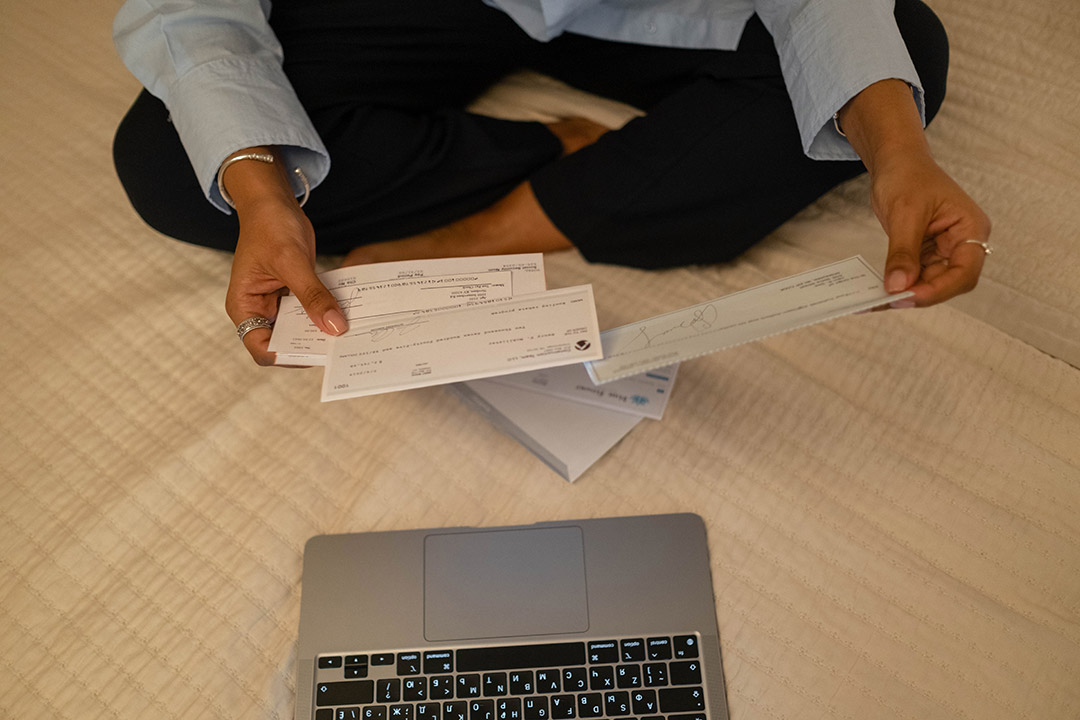

This fraud is usually committed in various forms including counterfeit cheques, cheque kiting, paper hanging, stolen and altered cheques (forgery).

Tips for preventing cheque fraud

- Your cheques should be kept in a safe place

- Examine your monthly bank statement or check your transactions on a regular basis via online or phone banking. If you discover transactions that you did not make, notify HFB immediately on 0417803000/0200803000 or www.hfb.julisha.org , and we will conduct an investigation

- Electronic payments, such as wire transfers, direct deposits, pre-authorized payments for bills, or email money transfers, are more secure than cheques

- If you close your account, shred any unused cheques

How to protect yourself from fraudulent cheques given to you

- Details about the security features built into cheques are typically printed on the back of the cheque and can include watermarks and intricate designs that will vanish if the cheque is scanned or photocopied

- If you accept a cheque as payment for something you’re selling, know who you’re dealing with and, whenever possible, make sure the cheque, or bank draft has cleared and the money has been confirmed before you release the item to the buyer. This should be discussed when the buyer first contacts you about the item. If you are unsure about the transaction for any reason, or if you have any suspicions, do not proceed. Losing the sale is preferable to losing the item you were selling and the amount of the fraudulent cheque, money order, or bank draft

- If you are suspicious about money orders or bank drafts, you can have the bank contact the cheque writer’s bank to confirm its legitimacy

- Consider using electronic payment methods such as wire transfers especially if you don’t know who wrote the cheque. Cheques are less secure than electronic payments